Macro Overview

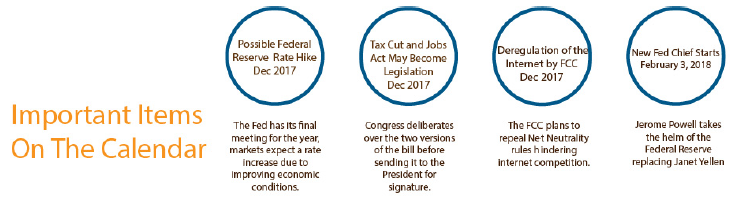

Both chambers of Congress have passed tax reform plans that will invoke among the most significant changes to the tax code since the Tax Reform Act of 1986. Versions of the Tax Cut and Jobs Act passed by the House in November and the Senate in early December will be modified into a single bill following Congressional deliberations..

Enactment of the tax bill would cut taxes by more than $1.4 trillion over 10 years, as estimated by the Join Committee on Taxation.Other projections also include a rise in the federal deficit, should economic growth not be sufficient to make up for the cost of the tax cuts.

Passage of the tax reform bill may eventually lead to higher inflation because of possible growth in the federal deficit and an expanding economy. Economic expansion produces inflationary pressures that can increase wages and asset prices such as homes and stocks. In addition, tapering of fiscal stimulus in Europe by the European Central Bank (ECB) may also add to international inflationary pressures, which has been one of the ECB’s primary objectives.

Equity markets rose in November with the Dow Jones Industrial Index climbing past 24,000 and the S&P 500 Index eclipsing the 2600 level, as the likelihood of tax reform passage became more apparent. Companies with strong balance sheets have been out performing those with weak balance sheets, as the market prepares for possible tax ramifications of companies deducting certain interest expenses. Markets expect the Fed to raise short-term rates again in December as improvements in the economy and labor markets materialized further.The unemployment rate dropped to 4.1% in October, the most recent data available from the Labor Department, the lowest rate since December 2000.

The internet will undergo deregulatory efforts with the repeal of an Obama administration rule set in place to regulate the internet with regulations similar to the utility industry.The FCC repealed Net Neutrality in November with the intent of increasing competition and alleviating regulatory oversight.

The Federal Reserve will have a new chief starting on February 3, 2018 with Jerome Powell replacing Janet Yellen. Senate confirmation hearings in late November buoyed markets as Jerome Powell expressed that the steady pace of monetary tightening under Yellen would continue under his watch. Mr. Powell is favored by the banking sector and financial markets because of his hands-on experience over the years.(Sources: Fed, Labor Dept., Dow Jones, S&P, Congress.gov/bill/115th-congress/house-bill/1)

What A Flattening Yield Curve Means – Bond Market Update

The anticipation of Fed rate hikes has gradually raised short-term rates this year, with the demand for longer-term bond maturities increasing. The result has been a flatter yield curve, where short-term rates have risen and long-term yields have dropped. A flattening yield curve implies that longer-term economic growth may be subdued or not expected to be very extensive

At the end of November, short-term rates such as the 2-year Treasury yield had risen to 1.75% from 1.22% at the beginning of the year. The longer-term 30-year Treasury bond yield fell to 2.77% on November 30th from 3.04% in January.

As promised, the Fed has started to curtail its buying of Mortgage Backed Securities (MBS). Through September, the Fed was buying an estimated 20-25% of the roughly $110 billion of MBS sold each month. In October, the Fed scaled back its purchases by $4 billion and is scheduled to reduce purchases by another $4 billion every quarter. As the Fed buys less and less MBS, the market will need to slowly absorb the additional paper made available by the Fed’s lack of buying. As this occurs, it is expected that MBS prices will gradually fall and yields will gradually rise. (Sources: Federal Reserve, Bloomberg, Treasury Department)

Itemized Deductions By Income Groups – Financial Planning

One of the most coveted tax tools proposed for elimination are various deductions.IRS data shows that approximately 70% of taxpayers take the standard deduction rather than taking itemized deductions. Taxpayers, regardless of their income, have the option of using either one. According to the IRS, over 30% of households choose to itemize their deductions in tax year 2013. Data also shows that households with incomes greater than $75,000 made most use of these deductions, validating that higher income households tend to itemize deductions. The same IRS data revealed that only 6% of tax returns with under $25,000 in income chose to itemize, while over 93% of tax returns with over $200,000 in income itemized. Households with higher incomes are more likely to pay more in state and local taxes, take larger mortgages, and donate to charities. All of these can lead to sizeable deductions on a tax return. The Tax Foundation concludes that itemized deductions mostly benefit wealthy taxpayers and is the

reason why many recent tax reform proposals have sought to limit or eliminate them. (Sources: IRS, Tax Foundation)

The Internet Is Being Deregulated – Government Regulations

The primary growth behind the internet isn’t the number of websites, but the growth of traffic within the invisible freeways it commands. The evolution of technology has enabled nearly every American to have access to the internet, but at a price. As the number of users grew so did the volume of traffic, which like a highway, eventually needs speed limits. These speed limits were imposed during the prior administration with the intent of making the internet equally accessible to all users. Many have complained that the utility-like regulations have hindered competition and limited the entrance of new technology

Data compiled by Internet Live Stats estimates that there are over 3.7 billion internet users worldwide, with nearly 287 million in the United States. As a percentage of population, the U.S. ranks 40th in internet users internationally, with roughly 88% of Americans having internet access. Scandinavian countries have among the highest percentages of users, with Denmark at 96.9% and Iceland at 100%. Many have argued that unnecessary regulations and minimal competition have limited additional users inthe U.S.

The Federal Communications Commission (FCC) voted in November to repeal 1930s era utility style regulation called Title II which has put at risk online investment and innovation since it was enacted in 2015 by the prior administration.The FCC plans to encourage a free and open internet by promoting broadband deployment in rural American towns and new infrastructure investments throughout the nation.The FCC outlines that it will honor and expand on the four “Internet Freedoms” implemented in 2004; freedom to access lawful content, freedom to use applications, freedom to attach personal devices to the network, and freedom to obtain service plan information. (Sources: Internet Live Stats, Federal Communications Commission)

Equity Update – Domestic Stock Markets

The Dow pierced through 24,000 towards the end of November as optimism about tax reform passage intensified.A primary emphasis to reduce both corporate tax rates and small business rates accelerated equity prices higher as optimism grew with the realization of passage.

The relationship between corporate taxes and equity valuations have been significant with the anticipation of a lower corporate rate, which has been elevating stocks ever since the election. The reduction in the corporate rate from 35% to 20% is expected to benefit certain companies more than others as tax rates vary among sectors.

Analysts view the recent decline in the technology sector as a form of market rotation,the exodus of assets from one market sector to another.The anticipation of various tax reform proposals may adversely affect technology companies while benefiting other industry sectors.The passage of tax reform might also prompt a further rotation to companies that may benefit from corporate tax proposals once in effect. (Sources: Dow Jones, S&P, Bloomberg)

What Taxpayers Own Stocks – Consumer Review

Tax reform has created questions about which taxpayers actually own stocks and benefit from certain tax provisions. Tax reform legislation has presented various proposals that would benefit long-term investors in the market. Repealing the estate tax would allow more families to transfer wealth accumulated in assets such as stocks to heirs without paying a tax. Corporate tax cuts and repatriated cash would benefit stock prices as companies would be enticed to buy back stock, increase dividends or invest in capital expansion.

Either way, the eventual benefits of these new tax rules are expected to benefit stockholders. Unfortunately, the bulk of households that own stock are in the upper income brackets, meaning that many don’t get to participate in any stock market increases resulting from tax reform.Federal Reserve data shows that 95% of families in the top 10% by income hold stocks directly and/or mutual funds that hold stocks, while lower income households tend to have much less. (Source: St. Louis Federal Reserve)

The Tax Cut and Jobs Act – Fiscal Policy Update

Senate and House Republicans each passed their own version of the Tax Cuts and Jobs Act, yet differ in various ways, setting arguments into motion.When the chambers pass different versions of a bill, conferees are appointed by both the House and the Senate to produce a “conference report” that is satisfactory to the majority of conferees from each chamber.The closer the two sides are going into conference, the easier the resulting process.

The focus of the Tax Cuts and Jobs Act is to lower taxes mainly for corporations and smaller businesses, and a portion of individual taxpayers.Targeted are wealthy individuals who live in high tax states that may lose valuable deductions. So the emphasis of tax reform this time around is on reducing corporate taxes,paid for by higher taxes on wealthier individuals due to a sustained top tax rate and loss of various deductions.

Some of the proposals where both the House and the Senate agree:

Retain the state and local tax property tax deduction, capped at $10,000;Expand 529 college savings accounts to apply to some primary and secondary education; 20 percent corporate rate, reduced from 35%.

Before the President can formally endorse the passage of the tax reform proposals, both the House and Senate will have to agree on one plan. The objective is to have the House and Senate hash out the details of both plans into a single piece of legislation and have it ready for signature by the President by the end of the year. (Sources: Tax Foundation, IRS, Congress.gov/bill/115th-congress/house-bill/1)