Macro Overview

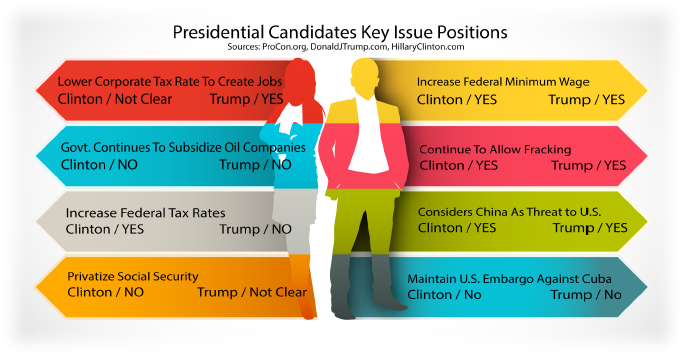

A tightening of presidential polls added to market ambivalence as uncertainty regarding what fiscal and regulatory policy changes might affect the economy and markets. The outcome of the U.S. elections is considered by many to be a primary determinant of how the rest of the year could evolve.

Fiscal policy has now become a central concern as monetary policy, which is dictated by the Federal Reserve, has become less effective and predictable. A reduction in federal income tax rates could lead to higher deficit spending, yet may contribute to a rise in GDP and consumer spending.

During its September meeting, the Fed decided to leave rates unchanged but strongly implied that an increase was on the horizon. The Bank of Japan kept its key rate unchanged at negative .10% with a target for its 10-year government yield at zero, a stark contrast to U.S. government bond yields. Lagging retail sales and stagnant industrial production reports possibly encouraged the Fed to hold off on a rate rise during its September meeting. The Fed has two more meetings before the end of the year, one the week before the presidential election and another in December. Several market analysts believe that the Fed won’t raise rates in No0vember, but will in December as it did in 2015.

The Atlanta Federal Reserve said its forecast of third-quarter real consumer spending growth fell from 3.0 percent to 2.7 percent, influenced by stagnant personal income and spending data for August. U.S. consumer spending fell in August for the first time in seven months while inflation showed signs of accelerating, mixed signals that could keep the Federal Reserve cautious about raising interest rates.

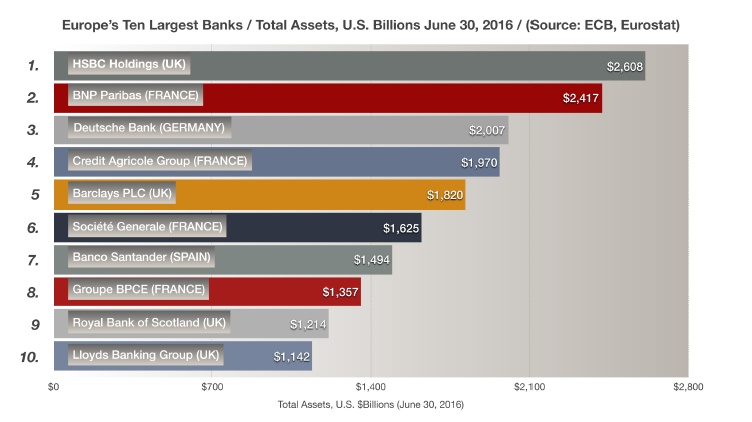

Anxiety over European banks has risen since the British voted to exit the EU. At first only smaller peripheral banks in Italy, Spain and Greece were of concern, but now larger banks in Germany have become focal points. Pressures are mounting for European banks as the low rate environment set by the ECB is starting to take its toll on bank earnings. An assemblance of dynamics has propelled Germany’s largest bank into a precarious position. (Sources: Fed, OPEC, Eurostat, Reuters, ECB)

Equity Update – Domestic Stocks

A data sensitive environment has evolved into a wait and see scenario as the Fed’s uncertainty regarding interest rates continues to cause volatility in the equity markets.

The third quarter was positive for equities as the technology and financial services sector provided gains for the major indices. For the quarter, the Dow Jones Industrial Average was up 2.78% and the S&P 500 Index added 3.85%, both on a total return basis. The technology heavy Nasdaq Composite Index was up 9.69% for the third quarter.

It’s always welcoming when the bond market helps the equity markets. The benefits of rising prices for high yield corporate bonds translate into lower borrowing costs for companies, thus leading to greater margins and propelling stock prices. (Sources: Reuters, Bloomberg)

Europe’s Biggest Banks – International Banking

The ultra-low rate environment fostered by Europe’s central bank, the ECB, has made it ever more difficult for European banks to make money. The ability of banks to create profitability is primarily based on the interest rate environment, as they lend at higher rates than what they’ve borrowed at.

Some of Europe’s largest and most prominent banks are German, part of the single largest and most influential economy throughout Europe. A combination of low rates, dismal economic growth, the effects of Brexit, and recent penalties imposed by the U.S. Justice Department has levied a tremendous strain on the German and European bank sectors.

Politics are also playing a critical part in how a banking crisis might evolve or be entirely missed. The Chancellor of Germany, Angela Merkel, vowed not to use German tax funds to help bail out banks and now with a reelection on the horizon, it is almost certain that any government bail out or assistance of any type will most likely not occur. German policy makers have been known for believing that the banks in the southern regions such as Italy and Greece should not be bailed out or rescued by their native country. (Sources: ECB, Eurostat)

The Country’s Busiest Airports – Travel & Leisure

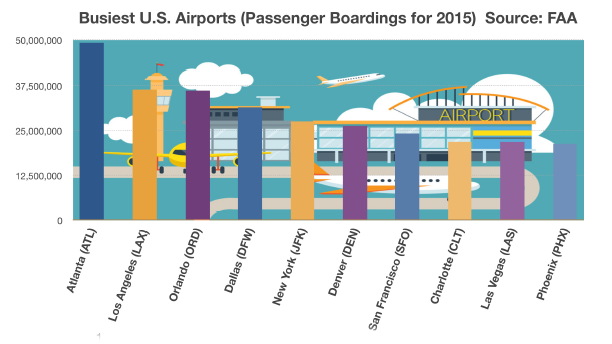

As both business and leisure travel have been increasing domestically and internationally, U.S. airports have seen an increase in passenger traffic. Some U.S. airports serve as international hubs with flights originating in foreign countries worldwide and landing there directly from a foreign destination.

With some of the most popular travel destinations in the world, American airports cater to tourists traveling both domestically and internationally. Not only is the Atlanta International Airport the busiest airport in the country, it is also the busiest passenger airport in the world, with Beijing a close second.Atlanta is also geographically attractive, located only a two-hour flight away from 80 percent of the U.S. population.

Various factors affect the accessibility of airports and how much traffic they generate. Denver International Airport is located in an extremely rural area of Denver, allowing vast amounts of rail and road traffic access to the airport. Chicago’s O’Hare and New York’s JKF are both situated directly within the city, yet accessible by millions of visitors. Geographic characteristics and access to airports allow some airports to handle more air traffic. (Sources: Dept of Transportation, FAA)

Various factors affect the accessibility of airports and how much traffic they generate. Denver International Airport is located in an extremely rural area of Denver, allowing vast amounts of rail and road traffic access to the airport. Chicago’s O’Hare and New York’s JKF are both situated directly within the city, yet accessible by millions of visitors. Geographic characteristics and access to airports allow some airports to handle more air traffic. (Sources: Dept of Transportation, FAA)

Fixed Income – Global Bond Markets

Some fixed income analysts believe that the Treasury yield curve is showing signs of mispriced bonds between long-term and short-term maturities, adding volatility to the overall bond market.

It is now estimated that there are over $12.6 trillion worth of bonds globally that yield less than zero. This dynamic is placing tremendous pressure on the world’s central banks to find a policy that will eventually stimulate economic growth and inflation. The Bank of Japan has had little if any success with its ultra-low negative yielding government bonds. All in all, this essentially means that Japanese rates will stay well below those in the United States for quite some time.

Money market funds reform has triggered a change in the London interbank offered rate, also known as Libor. Historically, higher Libor rates translate into higher long-term bond yields.

U.S. money fund reforms are set to take effect in the middle of October and have already affected short- term rates, notably the benchmark London Interbank offered rate also known as LIBOR. LIBOR is the base rate for many U.S. loans including various home mortgages, thus if LIBOR increases, then some mortgages in the U.S. could also see an increase in lending rates. Libor has risen by over 50 bps in the past year to 0.8456%, while the Fed has barely raised its short-term rate just 25 bps to 0.25-0.50%. (Sources: Bloomberg, Reuters)

Benefits of A Trust Versus a Will – Estate Planning

A properly drafted will or trust is essential for anyone that has assets to leave to heirs. Either a will or a trust allow you to designate anyone you wish as beneficiaries. Both a will and a “revocable living trust” allow you to identify who the heirs to your assets will be.

The main difference between the two is that assets held in a trust will avoid probate upon your passing, which is inhibitive to the heirs and costly. A trust structured as a revocable living trust can help shelter family assets from taxes by properly placing assets within the trust. Currently, the first $5.34 million (per individual) $10.68 million (per married couple) is excluded from estate taxes with any assets over that amount taxed at the Federal Estate Tax rate.

If you own property in another state, a living trust eliminates the need to probate that property in that state. A living trust can immediately transfer management of your property if you become incapacitated either physically or mentally. There is no need to go to court to appoint a guardian or conservator.

If you choose to create a living trust, you should also create what is called a pour-over will. It provides for the distribution of any property that is not included in the trust. It will also allow you to name a guardian for any minor children. (Source: IRS)

Food Prices Are Dropping – Consumer Behavior

The United States Department of Agriculture tracks a diverse basket of food prices each month in order to determine where price changes might affect consumers and their eating habits. No matter what age or demographical group an individual may belong to, food prices are a significant component of all household expenses.

For the period from August 2015 through August 2016, all food prices as a whole did not change, whereas in prior years price increases were more frequent. Yet there were some products that fell in price over the year, including meat, diary and poultry. The most recent data available shows that prices for eggs from August 2015 to August 2016 fell the most of all primary food items purchased by households nationwide. The average cost of a dozen eggs fell over 37% in a year’s time.

Consumers tend to respond to changes in food prices fairly quickly because of the frequent purchase of such items. The effect of price changes for larger,infrequent purchases such as automobiles and washing machines may not be as rapidly noticeable. (Sources: U.S. Dept. of Agriculture)