Macro Overview

An improving economic environment and earnings optimism propelled markets higher, along with prospects that there might be some agreement on tax reform in Washington.

The House of Representatives released a draft of tax policy proposals known as The Tax Cuts & Jobs Act.The prospect of lower taxes for corporations and individuals are part of the proposals, while also targeting tax avoidance by multinational U.S. firms, reassuring markets that fiscal reform could prove possible..

Effects of hurricane influenced rebuilding efforts underway in Texas and Florida are expected to become more visible via labor and materials data over the next few weeks.Economists expect an increase in job placements and material costs as insurance claims start to pay out. Hurricane Harvey destroyed over 15,500 homes in Texas, while Hurricane Irma damaged 90% of the homes in the Florida Keys.

Apart from hopeful tax reform passage, equity markets have soared due to stronger global demand, improving earnings,and fewer regulatory hurdles. Internationally, global growth surpassed 4.5% in the second quarter, following a 3.9% increase in the first quarter. The data suggests that global production and consumption is increasing, eventually translating into higher earnings for global equities. The International Monetary Fund (IMF) issued increased growth estimates for 2017 & 2018 following better than expected growth data.

The U.S. economy posted two consecutive quarters of GDP growth above 3% in the second and third quarters, marking the best six-month consistent period of growth in three years. Gross Domestic Product (GDP) grew at a 3.1% rate in the second quarter and 3% in the third quarter, per Commerce Department data. The subdued third quarter results are believed to be attributable to Hurricanes Harvey and Irma as economic activity came to a halt for portions of Texas and Florida. Economists believe that rebuilding efforts following the storms will give GDP growth a boost in the fourth quarter.Historically, U.S. GDP has averaged around 3% annual growth.

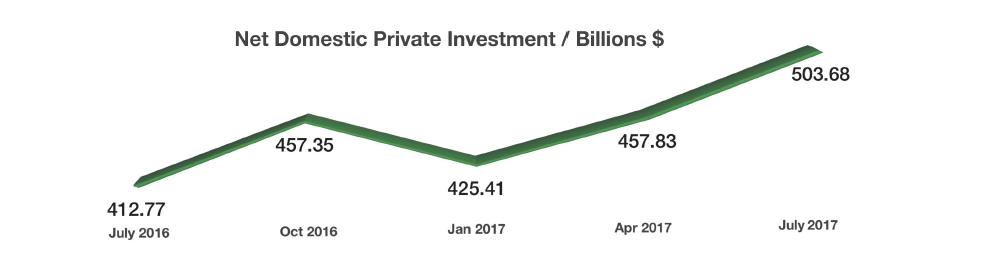

Proposed business tax reforms are expected to increase business investment, which has lagged in recent years. The Federal Reserve Bank of St. Louis released data showing that business investment rose in the second and third quarters. Overall, a rising trend in business investment is a confirmation of improved confidence held by companies on economic and tax reform prospects. (Sources: House.gov, Commerce Department, Federal Reserve)

Sinister Month Of October Rebuffed – Equity Markets

This October marked 30 years since the market drop of 1987, when the Dow Jones Industrial Average fell to 1,738, losing 508 points. The 22.6 percent collapse in 1987 is equivalent to a drop of about 5,200 points in the index today. The benchmark U.S. S&P 500 index plunged 20.5 percent on that same day in October 1987, equal to a drop of over 520 points today, and the Nasdaq dropped 11.4 percent, comparable to a drop of about 750 points. Another historical note is that October has been recognized as the most volatile month of the year. This past October was an exception, with the least amount of volatility of any October going back to 1928.

Earnings, the single most important factor for stock prices, have been rising in sync with stock prices, meaning that improved earnings validate higher equity prices.

International markets are following the rise of U.S. equity markets, reflecting optimism about world economic growth. Steady buying in U.S. markets has transitioned over to European, Asian, and emerging markets over the past few trading sessions. Broad-based economic growth internationally is fueling stock market appreciation as well as inflationary pressures. A weak dollar has also continued to buoy large U.S. multinationals allowing their products to be priced more competitively worldwide. (Sources: Dow Jones, S&P, Nasdaq, Bloomberg)

Social Security Payments Increasing By 2% – Retirement Planning

Social Security recipients are due to receive the largest increase in benefits in six years.But for many recipients, the increase in payments will go towards higher Medicare costs.The Social Security Administration announced a 2% increase in benefit payments effective in late December 2017 for disability beneficiaries and in January 2018 for retired beneficiaries. The 2% increase is the largest increase since a 3.6% increase in 2012.

Many are concerned that the 2% increase may not cover expenses that are rising at a faster rate, including other essential items such as food and housing. The latest increase also affects the premiums for Medicare Part B,which covers doctor visits and outpatient care.Medicare premiums are expected to increase at the beginning of the year, minimizing net increases in Social Security payments. The COLA adjustment for 2018 is 2.0%, a steep increase from the 2017 adjustment of only 0.3%. As of October 2017, over 66.7 million Americans currently receive Social Security benefit payments, with 46.3 million aged 65 or older. The Social Security Administration estimates that Americans will receive over $931 billion in Social Security benefit payments in 2017.

By 2036, there will be almost twice as many older Americans eligible for benefits as today, from 41.9 million to 78.1 million. There are currently 2.9 workers for each Social Security beneficiary, by 2036 there will be 2.1 workers for every beneficiary. (Source: Social Security Administration)

House Of Representatives Tax Plan Overview – Fiscal Policy

The House of Representatives released highlights of proposed tax cuts and tax policy reform, known as The Tax Cuts & Jobs Act. The proposals are still preliminary and only a draft until modified and formally signed into law.It is expected that the final version may have numerous revisions as the proposal goes through the negotiating process.

In addition to a poor harvest, a growing demand for the fruit has also added upward pressure on the price.There are seven varieties of avocados grown commercially in California, with the Hass variety as the most popular, accounting for roughly 95 percent of all avocados grown.Avocados imported from Mexico have also been limited due to a poor harvest season as well. NAFTA currently allows the importation of fruits from Mexico with no tariffs. (Sources: U.S. Department of Agriculture, Hass Avocado Board)

Below are proposed key provisions:

- The current seven tax brackets would be reduced to four: 12 percent, 25 percent, 35 percent, with the

top rate of 39.6 percent remaining for those earning above $1 million. There would be no income tax

for those earning up to $24,000; - Corporate taxes would drop from 35 percent to 20 percent;

- Taxes pass-through (S Corps, LLCs, Sole proprietorships, partnerships) business income at a

maximum rate of 25 percent; - Standard deductions would nearly double from $6,350 to $12,000 for individuals and $12,700 to

$24,000 for married couples; - The Alternative Minimum Tax (AMT) is to be repealed;

- No changes on contribution limits to 401(k) retirement plans;

- The estate tax exclusion would increase from $5.49 million to $11.2 million, and be completely

repealed as of 2024; - Corporate profits generated overseas would be subject to a 12% tax;

- Home mortgage interest deductions will stay in place for existing homeowners, but will be capped for

new homeowners at $500,000, down from the current $1 million limit

A number of popular taxpayer deductions may also be reduced or eliminated.The idea presented is to simplify the tax filing process by eliminating multiple, tedious deductions and replace them with a single, larger standard deduction. Some of the deductions targeted as proposed in the draft of the bill include:

- Repeal personal casualty loss deductions;

- Limitation on wagering (gambling) loss deductions;

- Limit charitable contributions;

- Repeal deduction for tax preparation expenses;

- Repeal medical expense deductions;

- Repeal deduction for alimony payments;

- Repeal deduction for moving expenses. (Sources: House of Representatives, Tax Policy Center)

Shift In Bond Yields – Fixed Income Markets

The yield curve for U.S. government bonds is flattening while shorter-term rates have risen as Fed hike expectations have increased.The 2-year Treasury reached 1.60% in October, its highest level since 2008.Rising shorter-term maturity bonds with little or no change in longer-term maturities is viewed by economists as a pick up in shorter-term inflation as well as the expectation of a coming rate increase by the Federal Reserve.

The 10-year U.S. Treasury is becoming more of an attractive option for international investors as the yield on the benchmark bond has risen versus its developed market peers.The yield on the 10-year Treasury at the end of October was 2.38%, compared to a 0.04% yield on the Japanese 10-year government bond, 0.36% on Germany’s and 1.26% on the British 10-year government bond. (Sources: Bloomberg, Fed.)

Consumers Are Spending More & Saving Less – Consumer Behavior

Recent government data reveals that Americans have been supporting their spending with their savings. The increase in spending is also recognized by economists as a sign of optimism and consumer confidence.Commerce Department data show that consumers have been spending more, as measured by the Personal Consumption Expenditures (PCE), and saving less, as measured by the savings rate, which fell to a ten-year low of 3.1% in September.

For many Americans that save diligently, using credit to spend is usually a last resort. So, for those consumers, spending from savings occurs before tapping a credit card. The most recent data show that consumers, as measured by the PCE, have been spending more over the past year.The concern is that consumers are concurrently saving less, meaning that savings are starting to go towards expenditures.Economists view this dynamic as a possible rise in prices and inflationary pressures where current income may not be keeping up with rising inflation.

Continued job and wealth gains have inspired consumers to spend more confidently.Another notable data set, tracked by the Federal Reserve, is household net worth,which revealed an increase in its most recent release, adding to consumer confidence.(Sources: BLS, Federal Reserve Bank of St. Louis)

Social Security Numbers May Go Away – Consumer Awareness

Following the recent Equifax data breach that affected 143 million Americans, the administration has called on various federal departments and agencies to look into the vulnerabilities of the Social Security number system and what alternatives may exist.

Several proposed encryption methods are being considered to replace the current vulnerable 9-digit numbers. An idea being looked at is a private key that is basically a very long encrypted number that would require a pass code or pin, similar to a chip coded credit/debit card. Fortunately for Medicare users, Medicare cards will no longer brand Social Security numbers on them. Instead they will be replaced by a new set of number identifiers starting in April 2018.

When the Social Security Administration started issuing numbers in 1936, the intent was to track U.S. workers’ earnings in order to determine their Social Security benefits.Over the decades various government agencies and private companies started using the numbers as a general identifier,which was never the original intent.In order to do away with Social Security numbers, it would need to be voted on and approved by Congress. (Sources: Social Security Administration, Medicare.gov)