Macro Overview

The rally in stocks that began following the election in 2016 propelled through 2017 as optimism and expectations that growth oriented policies and tax cuts would materialize.Political turmoil was not a deterrent for the markets, as major U.S. equity indices finished the year at near record levels.

The Tax Cut & Jobs Act was signed into law by the President on December 22nd, setting the stage for new tax codes and rules effective January 1, 2018.Following the passage of the new tax law legislation, small businesses and larger corporations prepare for optimal methods of spending capital and expanding in 2018.

Congress passed a short-term funding plan to avert a government shutdown between December 22nd to January 19th. Since federal funding gaps are common,Congress institutes a continuing resolution or CR to provide interim funds in order to maintain government operations.

The Federal Reserve raised rates as expected with the objective of curtailing inflationary pressures.The December rate hike was the third of the year,pushing shorter-term rates higher,which are more sensitive to Fed rate increases. Overall, rates remained fairly stable in 2017, as inflation and economic growth were tepid. The 10-year Treasury yield ended 2017 at 2.40%, down from 2.45% at the beginning of the year.

Confusion surrounding prepayment of property taxes was a nationwide problem the last week of the year as homeowners rushed to prepay 2018 property tax bills without being certain if a deduction could be taken in 2017. In a statement, the IRS did specify that taxpayers could deduct prepaid 2018 state and local property taxes on 2017 returns only if the taxes were assessed before 2018.

(Sources: Congress.gov, Federal Reserve, IRS, U.S. Treasury)

New Rules Benefit 529 College Savings Plans – Estate Planning

The Tax Cuts and Jobs Act includes a provision to now allow 529 Plans to be used for private elementary and high school expenses, rather than just college related expenses. The new rules are a treat for both parents and grandparents looking for a better way to pay for private educational costs. Until now, the only plan that allowed for tax-free earnings growth was a Coverdell Education Savings Account (ESA). Limitations on contributions and income has made these plans unfavorable for many families. A key notable benefit to a 529 versus a Coverdell ESA includes transferability. Funds in a 529 account may be transferred from the original beneficiary to another. Another benefit is the fact that funds in a 529 may grow perpetually, and never have to be used. Some families are using this feature as an estate planning tool, allowing unused funds in a 529 to pass along to future recipients. The new tax plan does limit the amount used for K-12 expenses to $10,000 per year. Any current funds held in an existing Coverdell ESA account may be rolled over to a 529 plan with no tax consequences.

The accompanying chart details the new benefits to a 529 Plan versus a traditional Coverdell ESA plan:

Named after the IRS Code it falls under, Section 529 plans have ballooned to $282 billion in assets (as of the 3rd quarter of 2017) since their inception in 1997. Section 529 plans were initially intended to provide parents of young children the ability to invest money for future anticipated college related expenses. These plans offer two primary benefits: assets grow tax deferred and come out tax free for qualified expenses; and, contributions made by parents and grandparents are considered a gift, thus proving a tax benefit for some contributors. (Source: IRS, www.congress.gov/bill/115th-congress/house-bill/1)

Electric Cars Grew In Popularity In 2017 – Auto Industry Overview

The adoption of electric cars worldwide has been a trend for years, with limited options from only a few manufacturers. A recent surge of new entrants into the market along with rapidly advancing electric motor and battery technology has recently provided a flurry of additional options for consumers. Government subsidies and environmental sensitivity have also helped increase the popularity of electric vehicles and propelling sales upward. There are currently over 253 million cars and trucks on U.S. highways, with roughly 550,000 of them electric. Electric vehicles have also grown in popularity in other countries as new models and manufacturers have evolved. China, Japan, the Netherlands and Norway are among the countries with the largest amount of electric vehicles. Estimates for 2017 electric car sales in the U.S. are expected to be about 174,000 vehicles, up from 157,000 in 2016. Numerous manufacturers and brands have introduced new models prompting competition in the industry. (Sources: InsideEVs, Dept. of Transportation)

Drinking Less Milk But Eating More Cheese & Butter – Consumer Behavior

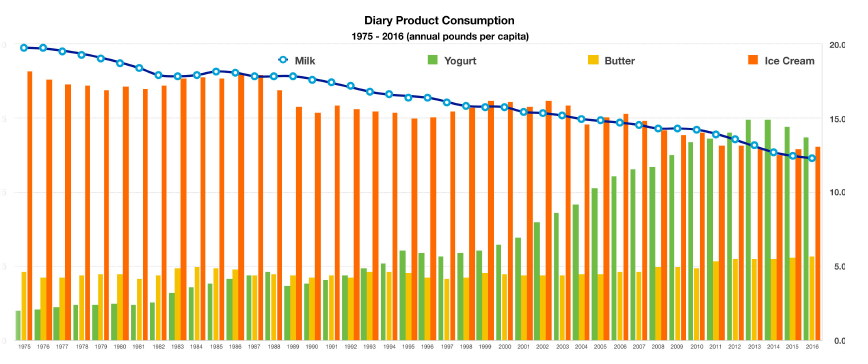

Even with its nutritional values, milk consumption in the Unites States has dropped by over 35% over the past 40 years.The steady decline in milk consumption is attributable to both diet and competition, as other forms of calcium rich drinks replace milk’s fatty perception. Recently, the market for milk alternatives has grown as non-dairy drinks made from ingredients such as almonds, coconut and soy have taken the place of milk.Even the well-liked and familiarly embraced “Got Milk” campaign was abandoned by the USDA after running for over 20 years because it essentially did nothing to boost milk consumption.

Milk is produced in all 50 states, with the majority of production in the Western and Northern states. The industry has experienced an overall decline in production nationwide for the past 25 years as consumption of various dairy products has also changed. As consumers have been drinking less milk, they are using more butter and eating much more yogurt. The trend with less milk consumption has also been accompanied by a drop in ice cream consumption. Recent medical reports suggests that the harm of eating butter and cheese may be over done. (Sources: USDA, National Milk Producers Federation)

Short Term Rates Heading Higher – Bond Market Overview

The Federal Reserve raised a key short-term rate as expected by the markets and made fairly optimistic comments about economic growth projections for 2018. The federal funds rate rose to a target range of 1.25 – 1.50%. The increase is a strategy of tightening and also meant to alleviate inflationary pressures. Concurrently, the Fed is also shrinking its $4.4 trillion balance sheet, a dual monetary policy effect expected to curtail inflation and reduce stimulus. Members of the Federal Reserve indirectly expressed concern about the labor market, suggesting that improvements in the job market were expected to ease.The Fed committee also maintained a conservative growth estimate for 2018 of 1.8%, hinting that the new tax plan may not yet produce economic benefits in 2018. The yield curve flattened throughout 2017, with a rise in short term rates and a drop in longer-term rates. The yield on the 2-year Treasury Note had its largest annual increase in over 10 years, ending the year at 1.89%, up from 1.22% at the beginning of January 2017.The benchmark 10-year Treasury bond yield saw almost no change in 2017, falling to 2.40% at year end from 2.45% in the beginning of January. The current Chair of the Fed, Janet Yellen, is scheduled to chair her last Fed meeting on January 30th & 31st, with Jerome Powell assuming the post in February. (Sources:

Federal Reserve, U.S. Treasury, Bloomberg)

The New Tax Bill – Fiscal Policy Review

Both individual taxpayers and companies will see broad changes for deductions and tax rates. The emphasis of the tax bill, known formally as the Tax Cuts & Jobs Act, is to stimulate economic activity via new and higher paying jobs.This is why many of the changes directly benefit large and small businesses in order to encourage hiring.

Some of the tax provisions enacted by the new tax act will be temporary, while others permanent.The cost of reduced tax revenue brought about by tax cuts may only be viable for a certain period, thus producing more immediate benefits from tax cuts rather than later.

Affecting essentially every taxpayer is the increase in the standard deduction, which is meant to simplify the tax

preparation process by replacing itemized deductions with a larger standard deduction.

The IRS estimates that about 95% of the businesses in the United States are pass-through entities, such as sole proprietors, S-Corps, LLCs, and partnerships.These entities are called pass-throughs because the profits generated are passed directly through the business to the owners, which are taxed at the owners’ individual income tax rates. The new tax law allows for a 20% deduction of that income, thus reducing overall taxable income. According to the Tax Foundation, pass-through businesses account for over 55% of all private sector employment, representing over 65.5 million workers nationwide. (Sources: IRS, www.congress.gov/bill/115th-congress/house-bill/1)

Equity Overview – Global Stock Update

SGlobal markets accelerated throughout 2017, marking new highs and sending broader market indices higher. The election prompted rally in domestic stocks continued on in 2017 as optimism and expectations that growth oriented policies and tax cuts would fuel earnings appreciation.

International markets excelled in 2017 as both developing and emerging stocks were boosted by expanding economies throughout Europe and Asia.

The new tax law imposes a repatriation tax on cash held overseas by U.S. corporations. A tax of 15.5% on liquid assets will affect various sectors and numerous companies that are estimated to have amassed over $2 trillion overseas. The new rate is considerably lower than the previous rate of 35%, incentivizing companies to bring cash back to the U.S.

the several sectors encompassing the equity markets, technology and healthcare companies hold the most cash overseas, placing them at the forefront of bringing billions of dollars back to the U.S. at the preferable tax rate.

(Sources: Bloomberg, Reuters, www.congress.gov/bill/115th-congress/house-bill/1